In the realm of personal finance and credit management, MeineSchufa stands as a household name in Germany. This credit reporting agency plays a pivotal role in assessing the creditworthiness of individuals and businesses, wielding significant influence over financial decisions and opportunities. In this comprehensive article, we will delve deep into the world of MeineSchufa, exploring its history, purpose, functions, and the critical role it plays in Germany’s financial landscape.

The Genesis of MeineSchufa

MeineSchufa, short for “Meine Schutzgemeinschaft für allgemeine Kreditsicherung,” can be translated as “My Protection Community for General Credit Protection.” It was established in 1927, making it one of the oldest credit reporting agencies in the world. Originally created as a non-profit association, MeineSchufa’s primary goal was to protect businesses and lenders from financial risk by providing comprehensive credit information.

The Core Functions of MeineSchufa

At its core, MeineSchufa serves two main purposes:

- Credit Reporting: MeineSchufa collects and maintains credit data on individuals and businesses. This data includes information on loans, credit cards, payment histories, and other financial obligations. Lenders and businesses use this data to assess the creditworthiness of applicants before extending credit or entering into financial agreements.

- Fraud Prevention: MeineSchufa also helps prevent fraud by providing businesses with tools to verify the identities of customers and applicants. This helps protect both consumers and businesses from identity theft and fraudulent financial activities.

Data Collection and Sources

MeineSchufa gathers its data from various sources, including:

- Creditors and Lenders: Banks, credit card companies, leasing agencies, and other financial institutions regularly report customer data to MeineSchufa. This data includes information on credit limits, outstanding balances, payment history, and more.

- Public Records: MeineSchufa also collects data from public sources, such as court records, bankruptcy filings, and insolvency proceedings. This information can have a significant impact on an individual’s credit score.

- Self-reporting: Individuals can also voluntarily provide additional information to MeineSchufa to improve their credit profile. For example, providing proof of regular income or rental payments can positively influence one’s credit score.

Credit Scoring System

MeineSchufa uses a credit scoring system to evaluate the creditworthiness of individuals and businesses. The most well-known credit score in Germany is the Schufa Score, which ranges from 0 to 1000. A higher score indicates better creditworthiness, while a lower score suggests a higher credit risk.

Factors that can impact your Schufa Score include:

- Payment History: Timely payments on loans, credit cards, and other financial obligations have a positive impact on your score.

- Outstanding Debts: High levels of debt can negatively affect your score, especially if your credit utilization ratio is too high.

- Length of Credit History: A longer credit history is generally viewed more positively, as it provides a more comprehensive picture of your financial behavior.

- Recent Credit Applications: Multiple credit inquiries in a short period may indicate financial stress and can lower your score.

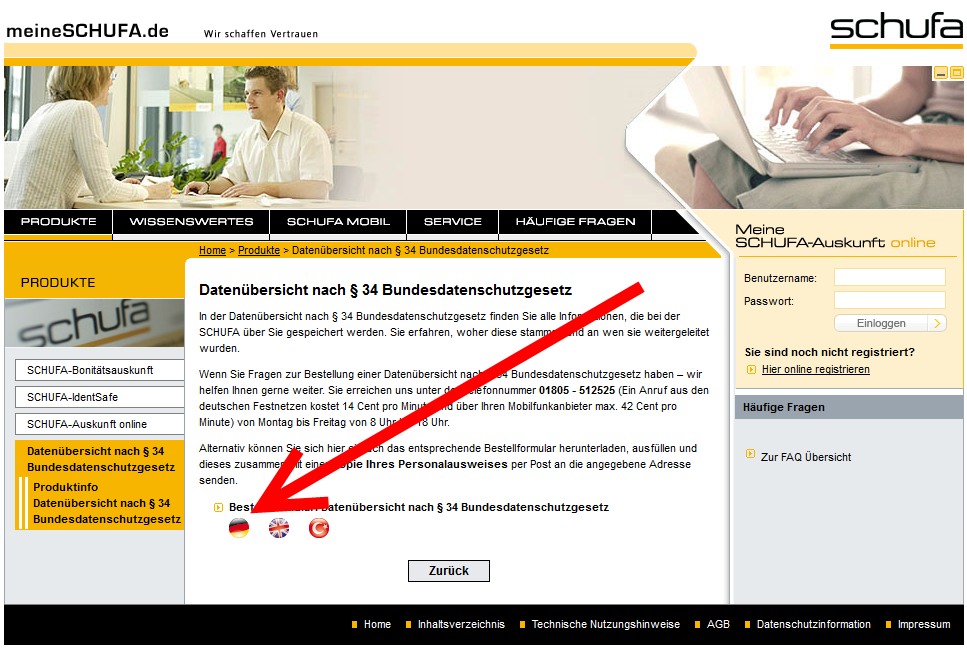

Accessing Your Schufa Report

Every individual in Germany has the right to access their Schufa report for free once a year. This report provides a detailed overview of your credit history and includes your Schufa Score. You can request your report online or by mail, and it is crucial to review it regularly to ensure accuracy and address any potential errors.

The Impact of MeineSchufa on Financial Decisions

MeineSchufa’s influence on financial decisions in Germany cannot be overstated. Lenders, landlords, and even employers may request your Schufa Score and report to assess your creditworthiness, rental eligibility, or suitability for certain job positions. A negative entry or a low credit score can limit your access to credit, housing, and job opportunities.

Data Protection and Privacy Concerns

The extensive collection and use of personal financial data by MeineSchufa have raised privacy concerns over the years. Critics argue that the agency’s practices can be invasive and that individuals should have more control over their own financial data. In response to these concerns, data protection laws have been strengthened in Germany to give individuals more rights and control over their personal information.

MeineSchufa plays a vital role in Germany’s financial ecosystem, serving as the gatekeeper to various financial opportunities. While it offers significant benefits to lenders and businesses, it also raises important questions about data privacy and consumer rights. As MeineSchufa continues to evolve, it remains an integral part of the financial lives of millions of Germans, shaping the way they access credit, housing, and employment opportunities. Understanding its functions and the impact it has on individuals’ lives is crucial for anyone navigating the German financial landscape.

- Tags:

- finance

- MeineSchufa

- services